unlevered free cash flow yield

It is financed partly by equity and partly by debt. In our previous post we discussed the meaning and calculation of free cash flow to firm FCFF which is often referred to as unlevered free cash flow.

Free Cash Flow Yield Formula Top Example Fcfy Calculation

The other Firm L is levered.

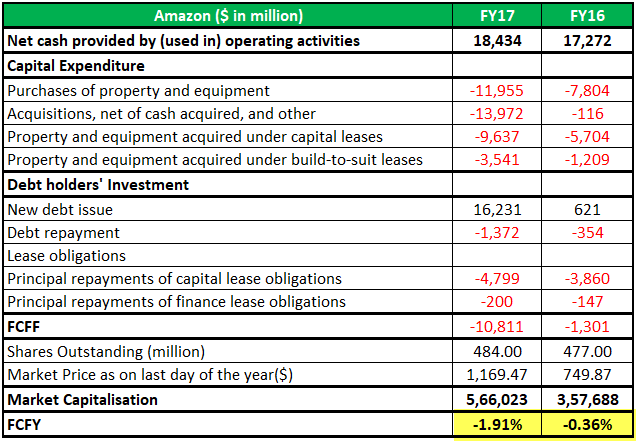

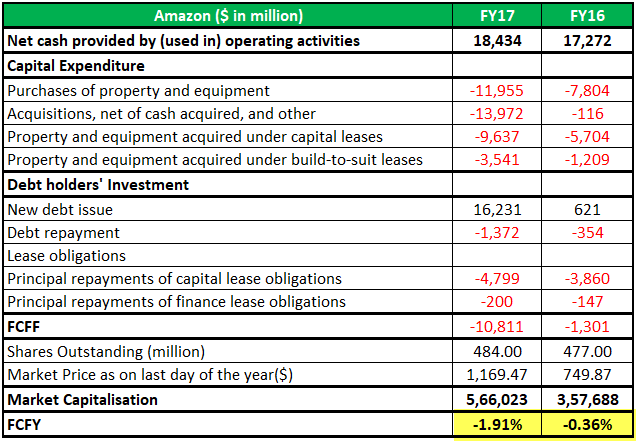

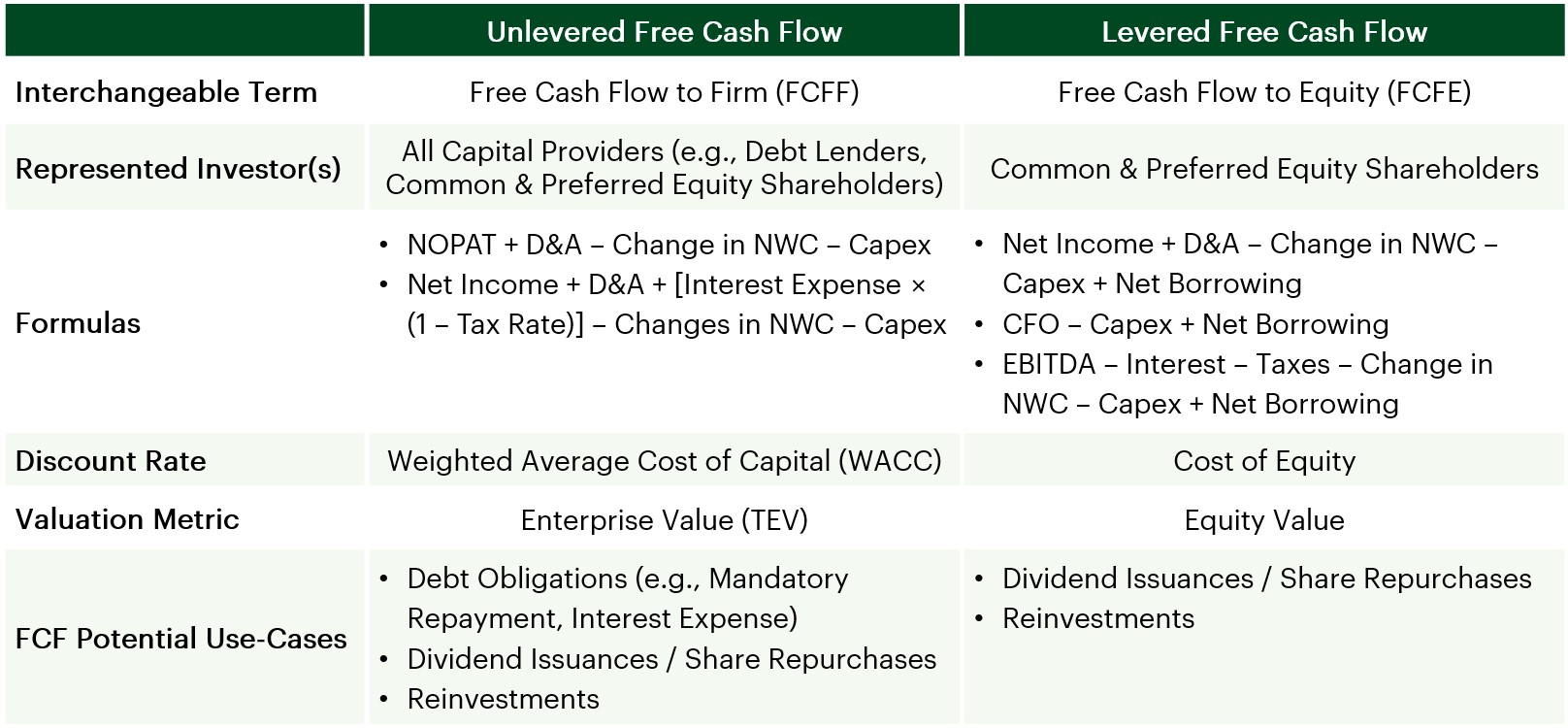

. Levered Free Cash Flow gives you Equity Value rather than Enterprise Value since the cash flow is only available to equity investors debt investors have already been paid with the interest payments. Free Cash Flow to Firm FCFF refers to the cash generated by the core operations of a company that belongs to all capital providers both debt and equity. This is the generally accepted definition.

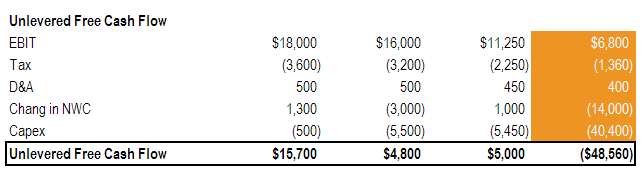

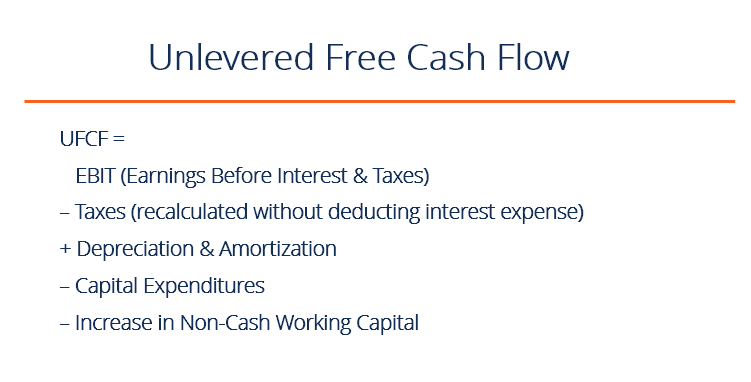

Free Cash Flow EBIT 1- T Depreciation CAPEX - NWC where. Lets say that you use Levered Free Cash Flow rather than Unlevered Free Cash Flow in your DCF - what is the effect. This is not to be confused with the value of the equity of the firm.

Analyst sponsorship can change over time as new information is. Without taxes Proposition I where is the value of an unlevered firm. Depreciation is noncash operating charges including depreciation depletion and amortization recognized for tax purposes.

T is the marginal cash not average tax rate which should be inclusive of federal state and local and foreign jurisdictional taxes. It is also thought of as cash flow after a firm has met its financial obligations. Unlevered free cash flow ie cash flows before interest payments is defined as EBITDA - CAPEX - changes in net working capital - taxes.

That is it is financed by equity only. A positive endorsement that an analyst makes regarding a companys stock. When performing a discounted cash flow with levered free cash flow - you will calculate the equity value.

Free Cash Flow to Equity FCFE Definition. Used interchangeably with unlevered free cash flow the FCFF metric accounts for all recurring operating expenses and re-investment expenditures while excluding all outflows related to lenders such as interest expense payments. The reason for this is that the effects of debt financing have been removed namely interest expense the tax shield ie savings from interest being tax-deductible and principal.

While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. EBIT is earnings before interest and taxes. If there are mandatory repayments of debt then some analysts utilize levered free cash flow which is the same formula above but less interest and mandatory principal repayments.

The first Firm U is unlevered. The ModiglianiMiller theorem states that the enterprise value of the two firms is the same.

Unlevered Free Cash Flow Ufcf Lumovest

Free Cash Flow Yield Explained

Unlevered Free Cash Flow Definition Examples Formula

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Vs Levered Free Cash Flow Yield Fcff Vs Fcfe

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Vs Levered Free Cash Flow Yield Fcff Vs Fcfe